120% deduction for skills training & technology costs

This was originally announced in 2022 budget by the Morrison Government. It has been adopted by the current Government and on the 21st June 2023, the legislation to allow these measures was finally passed.

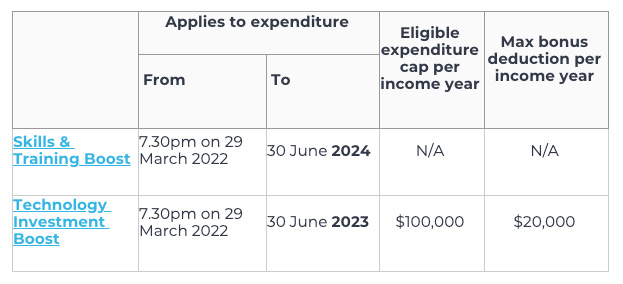

Technology Investment Boost

The Technology Investment Boost is a 120% tax deduction for expenditure incurred on business expenses and depreciating assets that support digital adoption, such as portable payment devices, cyber security systems, or subscriptions to cloud-based services.

The boost is capped at $100,000 per income year with a maximum deduction of $20,000.

The $20,000 bonus deduction is not paid to the business in cash but is used to offset against the assessable income. If the company is in a loss position, then the bonus deduction would increase the tax loss. The cash value to the business of the bonus deduction will depend on whether it generates a taxable profit or loss during the relevant year and the rate of tax that applies.

Skills and Training Boost

The Skills and Training boost is a 120% tax deduction for expenditure incurred on external training courses provided to employees. This incentive will not apply to sole traders and independent contractors.

External training courses will need to be provided to employees in Australia or online and delivered by training organisations registered in Australia.

The training must be necessarily incurred in carrying on a business for the purpose of gaining or producing income. That is, there needs to be a nexus between the training provided and how the business produces its income.

Note that the additional deduction relating to the 2021/22 financial year is to be claimed in the 2023 tax returns.

If you require further information on any of these measures, please do not hesitate to contact our office on (07) 3367 3366.