The 2023 Federal Budget was very underwhelming tax-wise with the primary focus being measures aimed at lowering the cost of living or improving welfare.

This budget is a first-term government setting the tone to win a second and third term. It’s not a big spending budget and the government is banking a lot of the tax windfall it will receive over the next 4 years. The numbers are a bit rubbery, but it is a good start to repair the budget.

There is little to no structural change to the tax system, and they have left the stage 3 tax cuts alone. The government is doing everything it can to not break promises and to send a message about economic competence. Short of a drastic change in economic circumstances, I think the stage 3 tax cuts are here to stay.

The Treasurer, Dr Chalmers, has indicated that more “difficult decisions” will need to be made to sustainably fix the budget, but I think they are looking to the next term of government. Labor wants to bank some trust and goodwill with the electorate before it brings any major tax reform to the table.

BUDGET OVERVIEW

The key measures of the Budget affecting small business and what it means for you.

1. Temporary Full Expensing is Ending

Currently, most businesses that purchase business assets can claim 100% of its price in full, in the year that it’s purchased and ready for use. This will finish on 30 June 2023.

Recommendation: If you need to purchase a business asset and have the cashflow to do so, we recommend you purchase it BEFORE 30 June 2023 to be able to claim 100% of its cost in the 2023 year.

2. Instant Asset Write Off – $20K

Replacing temporary full expensing is the Small Business Instant Asset Write-off. Businesses with a turnover of less than $10 million, will be able to immediately deduct the full cost of eligible assets costing less than $20,000 (incl GST). Assets need to purchased and installed before 30 June 2024.

Assets that cost more than $20,000 will be added into a small business simplified depreciation pool and depreciated at 15% in the first year and 30% each year thereafter. Remember, this is a tax deduction, and it is not $20,000 cash back to you.

3. Low and Middle Income Tax Offset (LMITO) has ended

The temporary LMITO was introduced in the 2019 Budget and then extended during the COVID-19 pandemic. It resulted in extra tax refunds of between $675 and $1,500 (depending on your level of income) for individuals. The Government didn’t extend the LMITO, so it has ended as at 30 June 2022.

Lower tax refund: Individuals who received an extra tax refund of up to $1,500 in 2022 will not receive it again this year in 2023.

4. Small business failure to lodge penalty amnesty

An amnesty has been announced for small businesses with a turnover of less than $10m, and have fallen behind on their tax returns.

A small business will not be charged failure-to-lodge penalties for outstanding tax lodgements that are lodged between 1 June 2023 and 31 December 2023 that were originally due between 1 December 2019 to 29 February 2022.

You’ve got 7 months to sort this one out and avoid some fines if you need to catch up. Remember to reach out if you need a hand!

5. Super Stuff

The budget confirmed changes that were previously announced. From July 2026 employers will have to pay super at the same time as wages, rather than quarterly. This measure is designed to increase compliance with the legislation.

It won’t begin for 3 years but you will need to factor this into your future cashflow planning.

At the other end of the scale, very high superannuation balances will attract a higher rate of tax from 1 July 2025. Earnings on balances exceeding $3 million will pay tax on earnings at a rate of 30 per cent, 15% higher than the current rate of 15%. Earnings on balances below $3 million will continue to be taxed at the concessional rate of 15 per cent. Defined benefit interests will be appropriately valued and will have earnings taxed under this measure in a similar way to other interests to ensure commensurate treatment.

If you have a balance of more than $3 million in your Superfund you should do a complete review of your arrangements to determine the best tax strategies going forward.

6. Family Support

From 1 July this year, Parental Leave Pay and Dad and Partner Pay will combine into a single 20-week payment. A new family income test of $350,000 per annum will see nearly 3,000 additional parents become eligible for the entitlement each year. The Government has also committed to increase Paid Parental Leave to 26 weeks by 2026.

7. Tax incentive for energy efficiency

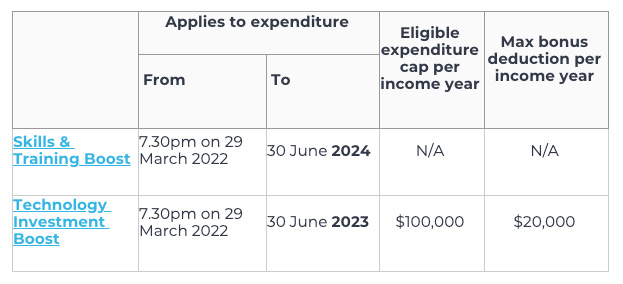

The Small Business Energy Incentive provides an additional deduction of 20% of the cost of eligible depreciating assets that support electrification and more efficient use of energy.

Up to $100,000 of total expenditure will be eligible, with a maximum bonus deduction of $20,000.

While the full detail of what qualifies for the incentive is not yet available, it is expected to apply to a range of depreciating assets and upgrades to existing assets such as electrifying heating and cooling systems, upgrading to more efficient fridges and induction cooktops, and installing batteries and heat pumps.

Some exclusions will apply including electric vehicles, renewable electricity generation assets, capital works, and assets that are not connected to the electricity grid and use fossil fuels.

8. Plan for higher PAYG instalments in 2024

Normally, PAYG instalments toward next year’s tax are adjusted using a GDP adjustment or uplift.

In 2022-23, the Government reduced this uplift factor to 2% instead of the 10% rate that would have applied. And now for 2023-24, the Government has set the uplift factor to 6% instead of the 12% rate that would have applied.

If you continue to make good business profits with tax to pay, you will need to budget for slightly higher PAYG instalments.

OTHER STUFF FOR SMALL BUSINESS

A few other “watch this space” announcements for supporting small businesses:

- $23.4 million Investment in Cyber Security

- $392.4 million Investment in an Industry Growth Program

- $18.1 million Investment in Buy Australia Plan

These types of investments tend to filter down through state government grants so keep an eye out.

These are the main measures affecting small businesses from this budget. Remember, these are subject to the measures passing through Parliament. If you require further information on any of these announced measures, please do not hesitate to contact our office on (07) 3367 3366.