What’s in it for Individuals & Families?

Flat White tax cuts — but not until July 2026

· The bottom tax bracket (from $18,201 to $45,000) drops from 16% to 15% in July 2026, and to 14% in July 2027

· Max saving: $268 in 2026–27, and $536 from 2027–28

· Roughly $5 per week from 1 July 2026 (barely enough for a Flat White Coffee), followed by roughly $10 per week 12 months after that

Medicare levy thresholds lifted for low-income earners

· Only applies to very low earners (e.g. $27,222 for singles, $45,907 for families in 2025–26)

· Reduces or removes Medicare levy for those under the thresholds

$150 energy rebate

· Applies to households and small businesses

· Paid in $75.00 quarterly chunks from July to December 2025

Subsidised childcare (income tested)

· From 1 Jan 2026: 3 days of subsidised childcare per week

· Replaces the current activity test

Cheaper medicines and better Medicare access

· $1.8B over 5 years for PBS

· $8.5B for more clinics and bulk billing

· $240M for women’s health (including menopause care)

HECS/HELP relief

· 20% cut to existing debt

· Repayment thresholds eased from 1 July 2025

Help to Buy scheme expanded

· Government can now chip in up to 40% equity in a new home

· Income threshold raised to $100k (single) and $160k (joint)

· Still not open for applications

What’s in it for Small Businesses?

Instant Asset Write-Off: Back to $1,000?

· The $20,000 write-off for 2024–25 has only just been passed into law, however…

· No extension for 2025–26, so from 1 July 2025 it reverts to the old $1,000 threshold

· Note the coalition has promised a permanent instant asset write-off threshold of $30,000 if elected.

Beer excise frozen

· From August 2025, beer won’t get more expensive due to indexation

· Alcohol producers get a small increase in support caps ($400k from July 2026)

· Overall: more headline than help

Non-compete clauses banned (from 2027)

· For lower and middle-income workers (<$175k)

· In practice, many small businesses don’t use these anyway

· Doesn’t affect non-solicitation clauses (which are still enforceable)

Phoenixing in the Construction Industry

· $3M to ASIC to improve the ability to identify and prosecute those involved in illegal phoenixing conduct – particularly within the construction industry.

ATO ramps up audits

· $1B allocated to expand compliance!

· Expect more attention on SMEs, high net worth’s and the cash economy

Housing & Foreign Investor Changes

· Foreign buyers banned from purchasing established homes for 2 years (from April 2025)

· CGT changes for foreign residents delayed until October 2025 at the earliest

Big Picture: The Economy

· GDP growth: 2.25% (2025–26), 2.5% (2026–27)

· Unemployment: Expected to peak at 4.25%

· Inflation: Tracking back to 2.5%

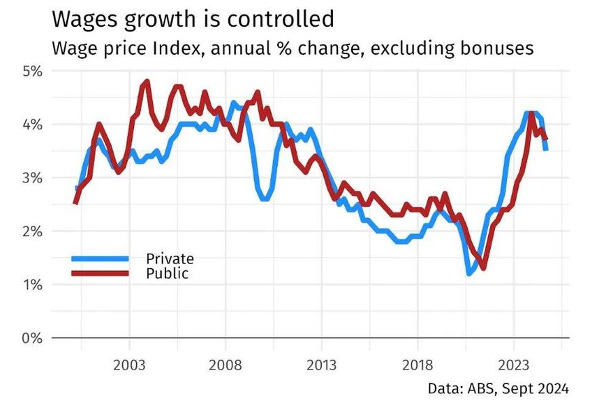

· Wages: Real wages growing slowly

· Budget deficit: -$42.1B in 2025–26

· National debt: Forecast to hit 23.1% of GDP by 2028/29 – $1.1 trillion

Our Take

There’s not much new here — a handful of sweeteners, but not a lot of substance.

As with the rest of the Budget, there’s unlikely to be an overwhelming reaction to the announcements. Forward estimates of inflation under control sooner than expected may bolster confidence in the broader market, as it brings into question whether interest rates can come down sooner, which supports business and share prices. From a tax perspective, cuts of 70c a day are unlikely to cause domestic listed retailers and service providers to whoop with joy.

The theme running through this year’s budget is ostensibly easing cost-of-living pressures for individuals and small businesses, but truth be told, it’s a pretty much “beige budget,” aimed more at pre-election pandering than implementing significant structural changes. However, amongst the serious fiscal measures, there’s funding for Giant Pandas ($3.8 million is being allocated to Adelaide Zoo over 5 years).